New Labour Codes Are Here: How to Avoid Penalties Using Statutory Compliance Software

India’s new labour codes mark one of the most significant regulatory shifts HR teams have seen in decades. Wage definitions have changed, compliance timelines have become tighter, and reporting expectations are far more structured now.

All of these have happened as a result of the central government consolidating the preexisting 29 labour laws into four comprehensive labour codes.

While this simplification should make things easier, it has created new adherence challenges for unprepared organisations. This is where statutory compliance software comes in. In this particular context, statutory compliance software refers to HR systems designed to manage labour law obligations such as payroll-linked compliance, employee records, attendance, and statutory filings.

This blog explains where risks arise and how to stay compliant without overcomplicating everyday HR operations with the help of a dedicated HR compliance management tool.

Understanding the Four Labour Codes: What Has Changed?

Through the New Labour Codes implementation that took place on the 21st November 2025, the government restructured decades of fragmented legislation, which were consolidated from over 29 central laws, into four principal codes.

These are the Code on Wages, Industrial Relations Code, Social Security Code, and Occupational Safety, Health and Working Conditions Code. Each code has specific provisions and directly impacts workforce management, compensation calculation, workplace safety, and employee benefits.

The codes aren’t the only hurdle. State-specific amendments and uneven rollout timelines add another layer of complexity. Some states have notified their rules; others are still deciding. For multi-state organisations, tracking these moving deadlines manually is close to impossible, which is why many HR leaders are turning to statutory compliance software to centralise updates.

14 Critical Areas Where Statutory Compliance Software Matters Most

HR compliance now demands continuous monitoring across wages, records, safety, and benefits. Regular audits are essential to prevent any gaps and thereby avoid consequential penalties. Here are the critical areas which using a reliable compliance management software can help solve.

1. Wage and Salary Regularisation

Under the Code on Wages, there is now a uniform definition of wages across all states. The basic pay, DA, and allowances need to be structured in such a way that these exclusions do not exceed 50% of the total remuneration. Where processes depend on manual handling, the risk of miscalculation and non-compliance increases. The right statutory compliance software to automate these dedicated payroll modules.

2. Digital Maintenance of Statutory Registers

The new codes mandate that all registers (Attendance, Wages, Fines, and Overtime) be maintained digitally. If you have been relying on the manual methods, it is not possible to keep the records audit-ready, tamper-proof, and accessible for inspection at any time. It will require you to switch to a reliable HR cum statutory compliance software with robust document management functionalities.

3. Full and Final (F&F) Settlement Timelines

A major shift in the new codes is the requirement to pay all dues within two working days of an employee’s removal, dismissal, retrenchment, or resignation. This tight window requires immediate coordination between HR and the Finance team. Things like attendance closure, leave balance finalisation, and last-pay calculations are areas where automation plays a critical role in avoiding delays and compliance breaches.

4. Overtime Calculation and Consent

The OSH Code (Occupational Safety, Health and Working Conditions) mandates that overtime must be paid at double the regular rate and requires explicit employee consent. Keeping a clear trail of consent logs and precise time-tracking is necessary to withstand regulatory scrutiny.

Workforce management statutory compliance software provides this audit trail by integrating time-tracking data with employee consent workflows. There will be accountability for every hour worked and, therefore, it is possible to ensure being paid according to the new legal mandates.

5. Social Security Contributions (PF, ESIC, & Gratuity)

The Social Security Code has been expanded to gig and platform workers. Organisations now have the massive responsibility to track the contributions for these diverse workforce types. Another thing is that while it was a five-year requirement previously, the new code entitles fixed-term employees (FTEs) to gratuity after just one year of continuous service.

This shift demands a more granular approach to tracking tenure and contract end dates and becomes another compelling reason for adopting statutory compliance software to automate various complex administrative tasks, such as:

- EPF registrations and monthly return filings

- ESI enrollments and contribution schedules

- Gratuity calculations and payment tracking

- Maternity benefit computations

- Professional tax registrations across states

6. Leave Encashment and Carry-Forward

The new labour codes have added a few layers to the process of leave encashment and carry-forward. Employees can now carry forward up to 30 days of earned leave to the following year, which sounds simple enough until you have to calculate its value during an exit. Because the definition of wages has changed, the amount you pay out for encashment might be higher than before.

Managing this manually, especially when trying to figure out which days were earned under which wage structure, can make things quite complicated. Using compliance software makes this a breeze by automatically capping carry-forwards and recalculating encashment values in real-time based on the latest salary components.

7. POSH (Prevention of Sexual Harassment) Reporting

Statutory compliance is not limited to the economic aspect alone. It broadly covers the safety side as well. HR teams of organisations have the non-negotiable obligation to maintain records of the Internal Committee (IC), and file the Annual POSH Compliance Report to the District Officer.

Many HR teams are confused about what this report should entail. It is a detailed statistical record that must include:

- The total number of sexual harassment complaints received.

- The number of complaints disposed of during the year.

- The number of cases pending for more than 90 days (with reasons for the delay).

- Details of awareness programs and workshops conducted for employees.

- The nature of any action taken by the employer or District Officer.

The role of the HR compliance management system here is to keep all trails of reports and documentation in one secure place and act as a digital vault for your investigation records. It is a much calmer way to ensure your workplace stays safe and your paperwork stays perfect.

8. Employee Documentation & Appointment Letters

The new codes make it mandatory to issue a formal Appointment Letter to every worker, including those in the unorganised sector. This has been a long-pending reform to ensure no workers remain off-the-books and there is legal clarity for both parties.

In the past, many workers (especially those on daily wages or in smaller setups) operated on verbal agreements, which made resolving disputes or claiming benefits nearly impossible. Now, every single hire must have a written document that clearly outlines their job title, wages, social security rights, and work schedule.

Managing this for a large or fluctuating workforce can quickly turn into a mountain of paperwork. Statutory compliance software for HR tasks simplifies this by:

- Generating compliant appointment letters instantly

- Enabling mobile e-signatures for faster onboarding

- Syncing Aadhaar-linked records with national databases

9. Gender Pay Parity and Equal Remuneration

The Code on Wages strictly prohibits discrimination in wages based on gender for the same or similar work. If two people are doing the same job or work of a similar nature, they should be paid the same, regardless of gender.

While the old Equal Remuneration Act already touched on this, the Code on Wages 2019 goes a step further by making it a core part of payroll compliance. The law looks at the entire wage package to ensure there’s no hidden bias in how allowances or bonuses are handed out.

For HR teams who feel that auditing and meeting compliance with this is like a time-consuming process, which in fact it is, the dependence on a statutory compliance integrated HR management system can:

- Automatically flag gender-based wage gaps by role

- Track pay consistency across genders at hiring

- Generate equal pay compliance reports instantly

10. Inter-State Migrant Worker Benefits

Under the Occupational Safety, Health and Working Conditions (OSH) Code, an inter-state migrant worker is now more broadly defined to include anyone who has come from one state and is employed in another. This is irrespective of whether they were recruited directly, through a contractor, or even if they migrated on their own.

For companies with a mobile workforce, the new codes mandate specific benefits like travel allowances for migrant workers. Tracking every employee on the payroll in the home state versus the work state might add significant compliance complexity.

One of the most significant updates in this regard is the journey allowance. Employers are now required to pay for the to-and-fro travel expenses for migrant workers to visit their native place once every 12 months.

11. Annual Health Check-ups (Age 40+)

Under the new OSH Code (Occupational Safety, Health and Working Conditions Code, 2020), if an employee is 40 or older, the company must provide them with a free health check-up every year. The goal is to catch health issues early, but for HR, it adds a whole new layer of scheduling and record-keeping in addition to the challenges of organising the employee wellness initiatives.

Managing records without system support and tracking who turned 40 this month and who is due for their appointment is a headache waiting to happen. Compliance management software could step in to make this easy by automatically flagging eligible employees and keeping a digital copy of their fitness certificates. This way, if an inspector asks for proof, you’ve got a neat, updated list ready to go.

12. Worker Re-skilling Fund Contributions

The Industrial Relations Code introduces a Worker Re-skilling Fund, which is a brand-new concept in Indian labour law. Essentially, if a company has to let go of workers (retrenchment), employers now have to contribute an amount equal to 15 days of the worker's last drawn wages into this special fund.

Workers can use this fund to learn new skills and find their next job faster. Employers must deposit this money into the government-notified account within 45 days of the retrenchment. Here is how the statutory compliance HR software fits this requirement into everyday workflows.

- Automatic Calculation: Instantly figuring out the 15-day wage amount for each departing worker.

- Deadline Alerts: Sending you reminders so you don't miss the 45-day window.

- Direct Remittance: Helping you generate the necessary forms to transfer the funds to the state-managed account.

13. Night Shift Consent for Women

The breadth of statutory compliance now covers a historic shift for women. While there is no restriction to their freedom to work night shifts (7 PM to 6 AM) across all sectors, employers must secureexplicit written consent from every woman working these hours.

Beyond just getting the yes, the OSH Code mandates specific safety benchmarks that HR must track:

- Safe Transportation: Providing door-to-door pick-up and drop-off in GPS-enabled vehicles with verified drivers.

- Workplace Security: Ensuring adequate lighting, CCTV surveillance, and the presence of female supervisors or security personnel.

- Emergency Response: Maintaining a 24/7 helpdesk or SOS mechanism for women on the late shift.

Obviously, this is a logistical mountain which most HR teams are going to have a tough time navigating through. Here too, the HR compliance management system offers simplified workflow in areas like sending digital consent forms to employees assigned to night rosters and maintaining a tamper-proof log of their responses. You can store vehicle logs and driver background checks in your HR document vault safely and be ready to produce them instantly in case of any inspection.

14. Commuting Accident Liability

In a big win for employee welfare, the Social Security Code 2020 (implemented in late 2025) has expanded coverage to include accidents that happen during a worker’s commute. Essentially, if an employee meets with a mishap while travelling between their home and the office, it is now legally treated as having occurred in the course of employment. This makes them eligible for compensation or ESIC benefits that were previously out of reach for off-site incidents.

To validate a claim, employers need to show a clear connection between the timing of the accident and the employee's work hours. If someone has an accident three hours after their shift ended, it might not qualify. This is where precise, timestamped attendance logs in the workplace statutory compliance software make claim verification easier.

- Exact Punch-in/out Data: To verify if the worker was indeed on their way to or from a shift.

- Geofencing Records: To confirm they were on their usual route.

- Integrated Claims Filing: To quickly sync attendance data with ESIC portals to facilitate employees getting help fast without the company facing a documentation audit.

Key Compliance Summary Table

| New Requirement | Deadline/Threshold | Penalties (up to) |

|---|---|---|

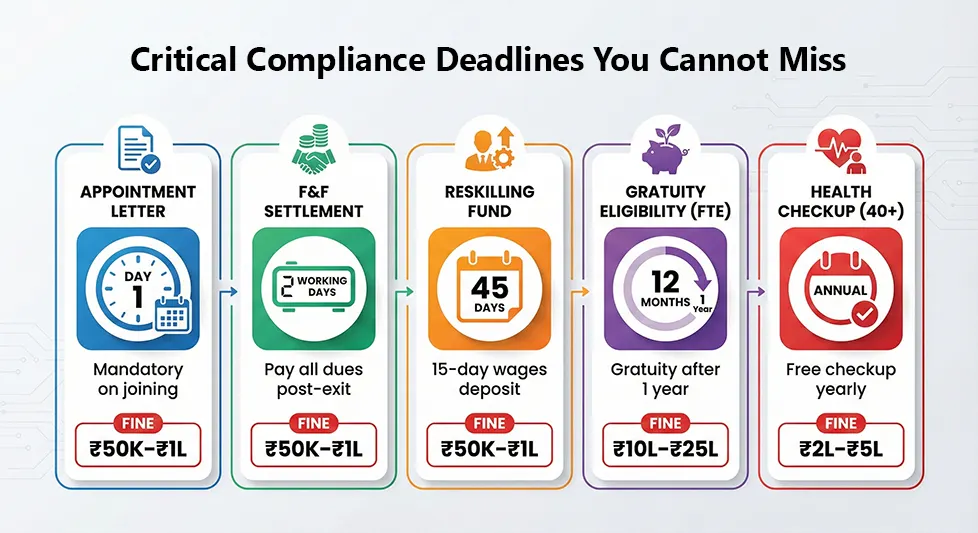

| Full & Final Settlement | Within 2 working days of resignation/termination/retrenchment/closure | Varies by state; potential interest + fine |

| 50% Wage Cap Rule | Applies to monthly payroll | Back-dated PF/ESI on excess allowances (up to ₹1.5L fine + 12% interest); repeat: jail 1–3 yrs + ₹2L fine |

| Worker Reskilling Fund | Deposit within 45 days of retrenchment (15 days' last wages per worker) | General non-compliance: ₹50k–₹1L fine; no specific penalty (tied to retrenchment violations) |

| Fixed-Term Gratuity | Pro-rata after 1 year continuous service (FTEs) | Non-payment: ₹10L–₹25L fine or jail 6m–2 yrs + ₹5L fine (repeat) |

| Annual Health Checkup | Free annual for workers 40+ (or hazardous: earlier) | OSH violation: ₹2L–₹5L fine; repeat: ₹4L–₹10L or jail 1–2 yrs |

| Gig Worker Fund | Annual: Aggregators 1–2% turnover (capped at 5% of gig payouts) | Non-contribution: ₹1L–₹5L + interest; repeat: higher fines/jail |

| Mandatory Appt. Letter | On Day 1 | ₹50k–₹1L fine (general OSH); 30-day notice before action |

Moving Toward Automated Compliance

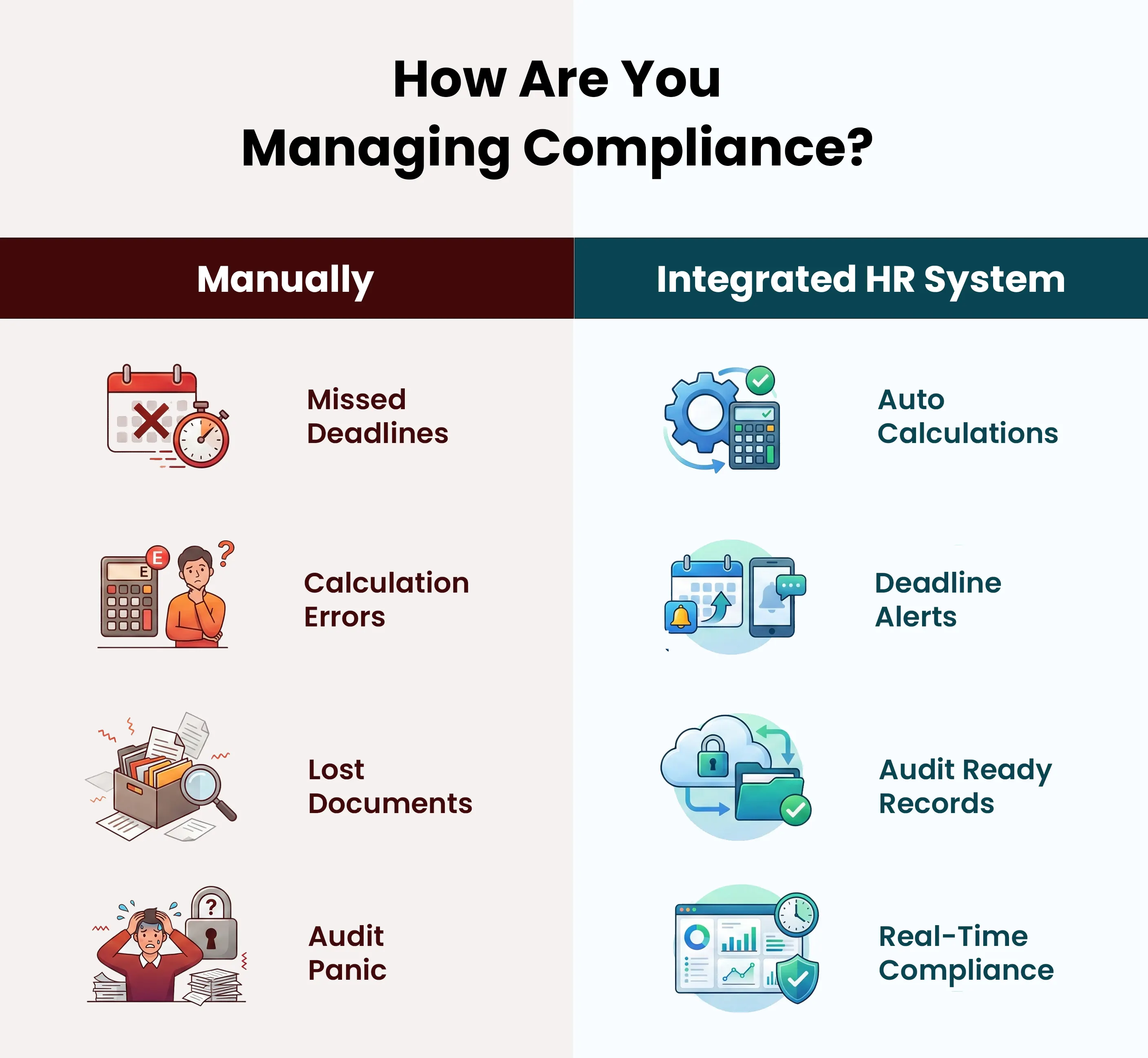

The sheer complexity of these 14 areas makes manual tracking a significant business risk. From the wage and salary regularisation to the commuting accident liability, the margin for non-compliance is extremely slim. The dependence on the right HR statutory compliance software becomes the safer route to limit legal exposure.

Can Integrated HR Systems Replace Standalone Statutory Compliance Software?

When it comes to picking the right statutory compliance software, it's easy to get overwhelmed by high-end tools marketed as dedicated compliance engines.

However, for most small and medium-sized businesses (SMBs), a separate subscription for compliance alone is an unnecessary expense. In the current 2025 landscape, over 90% of your daily regulatory hurdles, like the 50% wage rule, 48-hour weekly caps, or the new 1-year gratuity eligibility, are operational data problems which an integrated workforce management system can handle without extra overhead.

By choosing an HR system that proactively automates core tasks like time tracking, shift scheduling, and document storage, you are in a safe place to contain compliance risk at the source.

Conclusion

The transition to the 2025 labour codes might feel like a lot, but in essence, it is just about getting your data in order. Ask yourself: Could your current HR system double up as your statutory compliance software and survive a surprise audit tomorrow? Now is the perfect time to review your setup and ensure your business is fully protected for the road ahead.

Frequently Asked Questions

1. Is using a statutory compliance software mandatory for businesses under the new labour codes?

Statutory compliance software in itself is not legally mandatory, but what it does or the outcome it creates is mandatory. By using a reliable HR compliance system and automating calculations, deadlines, and records, you can considerably reduce compliance risks that are otherwise difficult to manage manually at scale.

2. Can statutory compliance management systems handle compliance for contract workers and temporary staff?

Modern compliance platforms manage all employment categories. This includes fixed-term contracts, temporary workers, consultants, and certain gig workers. Given that the Social Security Code now covers some gig workers with expanded definitions, the scope of statutory obligations has widened noticeably.

3. What happens to historical compliance data when switching from manual systems to new statutory compliance software?

Reputable platforms provide data migration services, using which you can transfer all your historical records with their data integrity and audit trails. In the employee management context, the common historical records cover past salary structures, previous PF/ESI contributions, leave balances and archived returns.

4. How often do labour code rules and compliance requirements change?

Labour code rules evolve frequently due to state-level notifications, amendments, and clarifications. Unless you are continuously monitoring these changes, it would be hard to know which version of the rule applies.

5. What should we evaluate before choosing a compliance platform?

You should assess rule configurability, state-wise compliance coverage, payroll integration, audit trail depth, update frequency, and the provider’s understanding of India’s labour law landscape.

Most Popular Post

Why Accurate Attendance and Leave Management Matters for Business Growth?

Read More →Why Accurate Attendance and Leave Management Matters for Business Growth?

How To Leverage Attendance Data For Better Workforce Management?

Read More →How To Leverage Attendance Data For Better Workforce Management?