The Impact of India’s New Labour Codes 2025 on HR Operations and Workforce Management

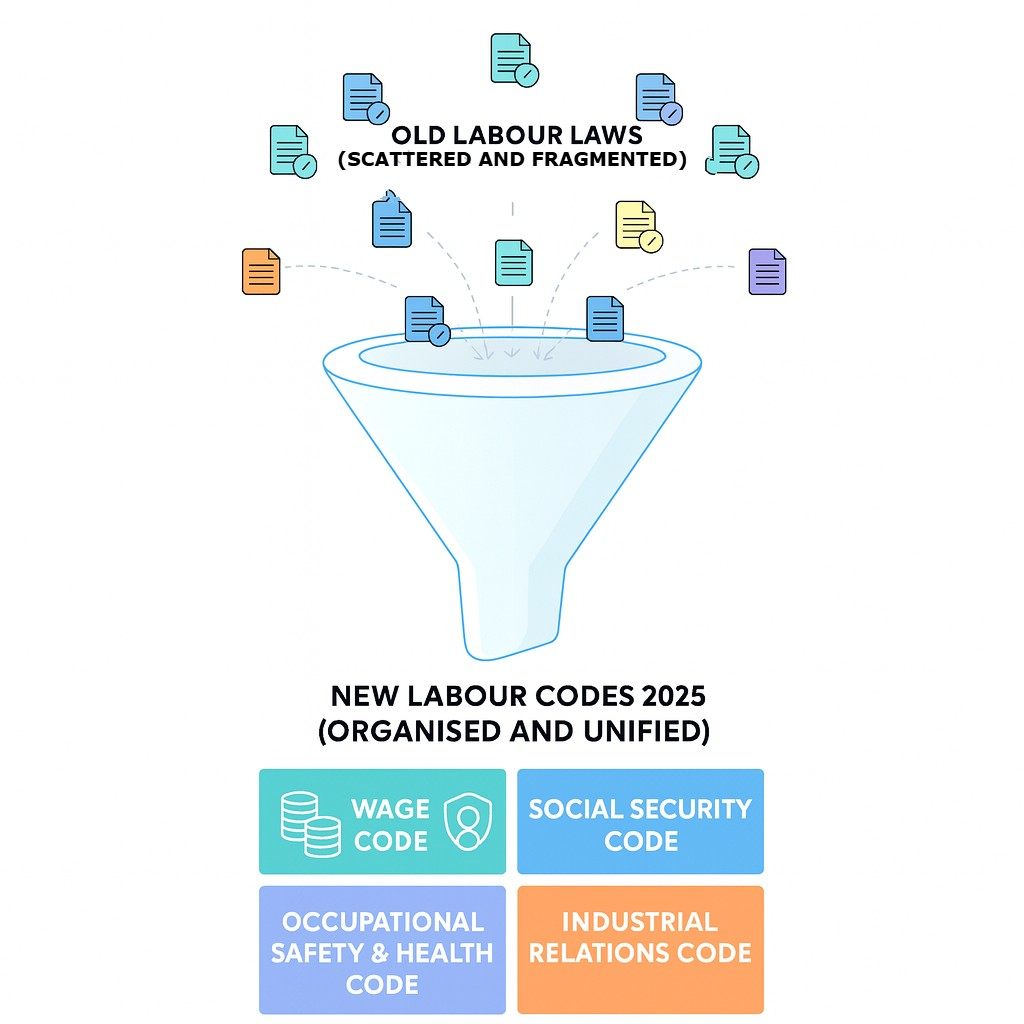

Something big changed on 21 November 2025. The government of India (The Ministry of Labour & Employment) put four consolidated labour codes into effect. These new codes bring together and replace 29 older labour laws that had been operating separately for decades.

For HR teams who work with policies and payroll all the time, this doesn’t feel like some far-off legal story. Because it is a daily operational one that defines how people are paid, who can be classified as employees, how layoffs should be documented, and what safety and social security must look like on the ground.

This blog picks apart those changes from an HR-first angle: what’s different, what might worry HR, and practical moves HR teams should make this week.

Labour Codes 2025: Major Changes HR Must Be Aware Of

Here’s a quick look at the four codes that now form the backbone of India’s labour regulations:

- Code on Wages, 2019

- Industrial Relations Code, 2020

- Code on Social Security, 2020

- Occupational Safety, Health & Working Conditions (OSHWC) Code, 2020.

Important Shifts Worth Noting

- Consolidation: 29 old statutes have been folded into four clearer codes. It means there are fewer statutes now, but more new rules to interpret.

- A changed definition of wages that affects CTC composition, PF, gratuity, and take-home pay. Employers will likely need to rework salary structures.

- Industrial relations flexibility: thresholds and approvals for layoffs/closures have been raised. It will now affect how unions, notices and approvals work.

- Formal recognition of gig and platform workers: They have been brought under the social security umbrella for the first time.

Old System Vs New Labour Codes: A Side-by-Side Comparison

| Aspect | Old System | New code (from 21 Nov 2025) |

|---|---|---|

| Number of central laws | 29 separate acts | 4 consolidated codes. Ministry of Labour & Employment |

| Layoff/closure permission threshold | Typically, 100 employees (varied across laws) | Higher thresholds for government approval, up to 300 in some cases. |

| Definition of wages | Varied allowances are excluded/included depending on the state laws | Redefined. Changes basic and allowances and will impact PF, gratuity, and take-home. |

| Gig workers | Largely outside formal social security | Recognised and eligible for social security provisions. |

| Work hours & overtime | 8–9 hr norms, multiple rules across sectors | Flexibility to extend daily hours (up to 12) within a 48-hour work week, and higher overtime pay |

| Safety & health | Fragmented safety rules | Uniform OSHWC code; mandated medical checkups in some cases. |

How The New Labour Codes 2025 Will Change Everyday HR Work (And What To Do)?

1) Payroll, CTC Architecture and Take-Home Pay

What changed:

The Code on Wages tightens what counts as wages. That shifts components (basic, allowances, reimbursements) and affects statutory contributions (PF/gratuity). Some employees may see a lower take-home if employers move more into basic salary, and statutory deductions rise.

What HR Should Do?

- Run a mapping of current salary slabs to the new wage definition: which allowances become part of wages?

- Recalculate PF, gratuity, and employer cost lines for representative employee bands (junior, mid, senior).

- Prepare employee-facing FAQs and example payslips explaining the change (clear communication prevents panic).

- Coordinate with the finance team to model net take-home impacts and tax implications.

2) Industrial Relations, Layoffs and Restructuring

What changed:

Thresholds for seeking government permission for layoffs/closures have increased; consultation frameworks are reworked. This gives firms more breathing room for scaling, but also raises union pushback risk.

What HR Should Do?

- Update the internal guide for workforce reductions(layoffs) with new thresholds, new notice and hearing requirements.

- Revisit collective bargaining agreements. Ensure that clauses match code provisions.

- Hold briefing sessions with managers on lawful redeployment vs. termination.

- Build a quick-response legal + HR checklist for any restructuring event.

3) Social Security and the Gig Workforce

What changed:

Gig and platform workers have received formal recognition and pathways to social security pensions, health, and insurance contributions. So a larger set of workers is now eligible for these benefits.

What HR Should Do?

- If you engage contingent workers like contractors, freelancers or platform workers, map who now falls within the social security scope.

- Start designing inclusion routes such as voluntary enrolment drives, portable benefit accounts, or contribution models for contract talent.

- Check with your payroll software providers and gig platforms to see what tech updates or integrations will be required.

4) Occupational Safety, Health and Working Conditions (OSHWC)

What changed:

The codes introduce a unified set of rules for workplace safety, medical checks, and working conditions. The standards are clearer, but the compliance expectations are stricter. Some provisions also require periodic medical check-ups for employees.

What HR Should Do?

- Audit physical workspaces against new OSHWC checklists (PPE, emergency drills, ergonomics, on-site medical arrangements, etc.).

- Contract with occupational health providers for mandated periodic checkups.

- Train frontline managers on incident reporting and record-keeping.

5) Working Hours, Night Shifts and Women’s Safety

What changed:

The code allows longer daily hours within a capped weekly limit. Provisions address night work for women with safety safeguards and support.

What HR Should Do?

- Revisit shift rosters and transport arrangements for night shift workers (especially for safety and legal compliance).

- Draft clear consent and safety protocols for women working night shifts. E.g., secure transport, on-call security and hotlines.

- Your time-keeping and overtime records need to stay up to date. Upgrade to an attendance, leave, and shift management system that can track variable daily hours and double-rate overtime accurately.

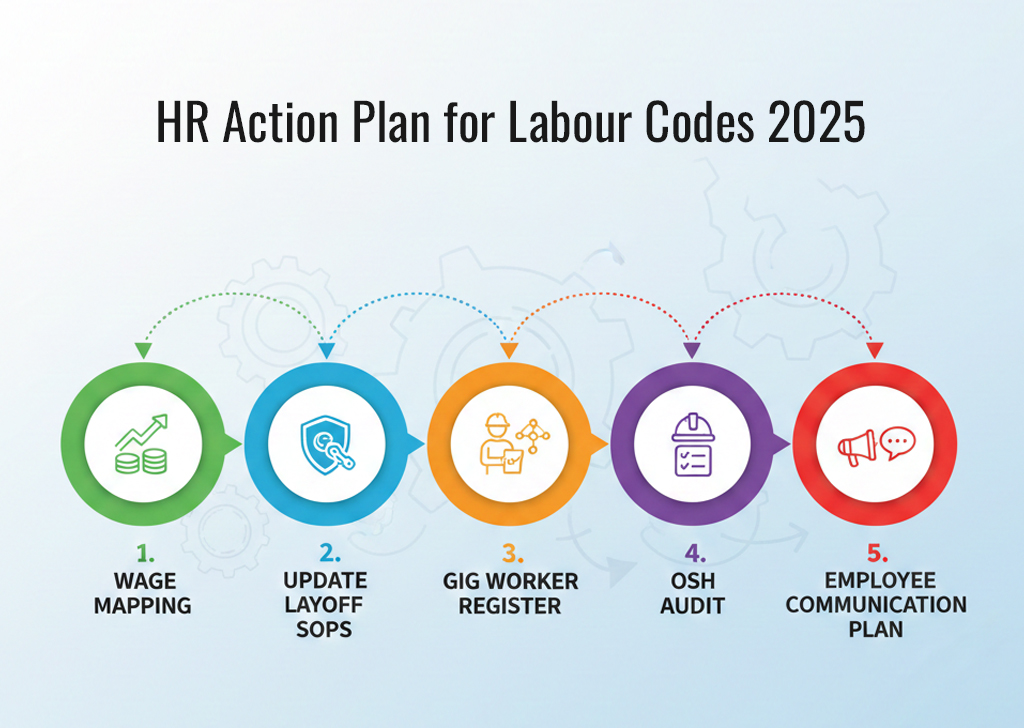

HR Action Plan Table for New Labour Codes 2025 Compliance

| Task | Why it matters | Who owns it | Timeframe |

|---|---|---|---|

| Map salary structures to the new wage definition | Affects take-home & statutory contributions. | Payroll + Finance | 1–2 weeks |

| Update termination/layoff SOP | Legal thresholds changed. | HRBP + Legal | 2 weeks |

| Gig worker register | New social security obligations. | Vendor Mgmt + HR | 2–4 weeks |

| OSH compliance audit | New unified safety expectations. | Facilities + HS&E | 2–3 weeks |

| Employee communication plan | Prevent unnecessary confusion and misunderstanding. | Internal Comms + HR | 1 week |

Three Likely Pain Points HR Will Face With the New Labour Codes and Solutions

Payroll System Glitches

Old payslip formats may stop working. If the system doesn’t read the new wage structure correctly, it can mix up deductions or allowances.

Quick fix: Run two sets of payslips for one month, compare the differences, and tell employees about any changes before the new payslip goes out.

Union Pushback During Reorganisations

Higher layoff thresholds don’t remove industrial sensitivity. Unions may still resist changes if they feel jobs, roles, or work conditions are at risk.

Quick Fix: Talk to union representatives early, share the facts openly, and try voluntary separation options before taking bigger steps.

Onboarding Gig Workers Into Benefits

Doing this manually can get time-consuming and confusing, especially when dealing with large numbers of workers.

Quick fix: Use benefit platforms that support bulk enrolment and portable IDs so everything can be added in one go.

How to Use the Labour Code Changes to Build Better Workplace Practices?

Most companies will likely treat the new Labour Code 2025 changes as asimple compliance task. They will do the necessary calculations, file the paperwork, and then mostly forget about it.

However, treating it this way is a real missed opportunity. Because these changes redefine wages and officially recognise gig workers, organisations can, in fact, use them to redesign their workplace practices.

For instance, by introducing things like portable pensions or skill credits, they can change their approach towards rewarding loyalty. They can also improve their approach to talent acquisition, perhaps by moving their best gig workers into permanent roles.

Furthermore, businesses can improve their reputation in the job market by offering clear payslips and demonstrating stronger safety records. In short, the new Labour Code 2025 changes give companies a chance to rethink their overall talent strategy instead of viewing the update as just another rule to follow.

How Mewurk Can Support You During This Transition?

Mewurk can help companies handle the changes brought by the New Labour codes. The new rules mean there is a lot more to keep track of, like making sure payroll is accurate, recording work hours, managing safety documents, and keeping records updated.

Mewurk makes all of this much simpler by bringing everything together in one place. The software keeps attendance, shifts, overtime, leave, payroll, and HR records organised and easy to update. Since the new codes have clearer rules about wages and stricter checks, it's incredibly helpful to have one system that does it all.

Mewurk also makes it easy for HR teams to send out updated payslips, communicate important information, and manage policy changes without having to deal with files all over the place. It gives HR a single, organised system to rely on while everyone gets used to the New Labour Codes 2025 changes.

Conclusion

The labour codes that came into force on 21 November 2025 do more than tidy law books. They rewrite everyday HR primitives: pay composition, who qualifies for social security, how layoffs must be handled, and what a safe work atmosphere means.

For HR teams, the immediate work is technical: updating payroll, checking employment contracts, and carrying out safety audits. Over time, the focus should shift to strategies such as designing benefits and talent models that work under the new rules. It is important to treat both with equal urgency, though.

FAQs

1. Do these codes immediately change employee take-home pay?

Possibly. The redefinition of wages can increase statutory contributions (PF, gratuity), which may lower take-home pay unless employers adjust allowances or gross CTC. Run sample salary calculations and explain the changes to employees before the next payroll cycle.

2. Are gig workers now entitled to the same benefits as regular employees?

Gig and platform workers are formally recognised for social security, but benefits may be designed differently (portable schemes, tailored contributions) rather than identical employer-sponsored packages.

3. Has the process for layoffs become easier for employers?

The codes raise thresholds and reduce steps in the approval process in certain contexts. Employers will certainly have more operational flexibility here. However, legal and union dynamics are to remain more sensitive. Hence, it will become even more important to follow new procedural steps closely.

4. What must HR do first under the New Labour Codes?

It’s best to begin with the tasks that can be acted on immediately, starting with payroll mapping. Run your salary structures against the new wage definition and prepare employee FAQs. Next, schedule an OSH audit and update any related safety procedures. These steps help address the most immediate risks and buy time to plan the larger reforms that will follow.

5. Where should companies look for authoritative guidance?

Start with the Ministry of Labour & Employment / PIB releases for official text and rules, then consult legal counsel and reputable business reporting for interpretation and implementation tips.

Most Popular Post

Why Accurate Attendance and Leave Management Matters for Business Growth?

Read More →Why Accurate Attendance and Leave Management Matters for Business Growth?

How To Leverage Attendance Data For Better Workforce Management?

Read More →How To Leverage Attendance Data For Better Workforce Management?