Understanding Overtime Policy in India: A Quick Guide for Employers and Employees

An overtime policy may look like a simple HR document, but it carries legal weight. It affects payroll accuracy, labour law compliance, employee trust, and even litigation risk. At a time when work-life balance is under scrutiny, nothing defines the boundary between paid work and personal time more clearly than an overtime policy.

Yet, many organisations still treat overtime policy informally, for instance, approving it over WhatsApp or calculating it loosely. This blog reflects the position under Indian labour laws as interpreted up to 2025. For state-specific applicability of overtime rules, consult your legal advisor.

What Is an Overtime Policy?

An overtime policy defines the rules under which employees can work beyond standard working hours and how that extra work is approved, paid, or compensated.

If there is a well-written overtime policy, it will make no confusion about:

- Who is eligible for overtime?

- When does overtime begin?

- How is overtime calculated?

- What approvals are required?

- How is overtime compensated?

In India, overtime regulations are primarily governed by various labour legislations, including the Factories Act, 1948, the Shops and Establishments Acts of different states, and more recently, provisions under the Code on Wages, 2019. Understanding these legal foundations is crucial for creating an effective overtime work policy.

Legal Basis of Overtime Policy in India

The foundation of any labour law overtime policy in India comes from statutory laws, primarily the Factories Act, 1948. Other laws may apply depending on the nature of the establishment, but the Factories Act remains the clearest reference point.

Overtime Policy as Per Factories Act

The overtime policy, as per the Factories Act, is one of the most comprehensive frameworks in Indian labour law. Under Section 59 of the Factories Act, 1948:

- Maximum working hours: No worker shall work more than 9 hours in any day or 48 hours in any week

- Overtime threshold: Any work beyond these limits qualifies as overtime

- Overtime compensation: Workers must receive wages at twice the ordinary rate of wages (double time pay)

- Maximum overtime limits: Total hours, including overtime, cannot exceed 60 hours per week or 10 hours per day

This overtime policy and procedure under the Factories Act applies to manufacturing units and factories across India and guarantees strong protections for industrial workers.

State-Specific Shop and Establishment Acts

For commercial establishments, IT companies, and service sectors, overtime regulations fall under state-specific Shops and Establishments Acts. These laws vary by state but generally provide:

- Standard working hours (typically 8–9 hours per day)

- Overtime compensation requirements (usually 1.5x to 2x the regular wage)

- Weekly hour limitations

- Rest day provisions

Overtime Pay Policy in IT Companies and Modern Workplaces

The overtime policy in IT companies operates differently from traditional manufacturing sectors. Many IT professionals are classified as managers or supervisors under labour laws, which sometimes exempts them from standard overtime provisions. However, ethical organisations implement robust overtime policies regardless of legal exemptions.

Key Considerations for IT and Service Sectors

Salaried employees

The overtime policy for salaried employees differs from hourly workers. While some organisations provide compensatory time off (comp-off) instead of monetary compensation, legally, employees entitled to overtime should receive appropriate payment or equivalent benefits.

Voluntary vs. mandatory

A mandatory overtime policy requires employees to work additional hours when business needs demand it. However, such policies must still comply with maximum working hour regulations and provide appropriate compensation.

Documentation requirements

Modern overtime policies require proper time tracking, approval workflows, and documentation to ensure transparency and legal compliance.

Who Is Eligible for Overtime in India?

Overtime eligibility in India depends on how an employee is classified under labour laws, the nature of their work, and the statute that applies to the establishment.

1. Factory workers

Workers covered under the Factories Act are entitled to overtime pay if they cross daily or weekly limits.

2. Salaried employees

An overtime policy for salaried employees depends on:

- Their role

- Level of authority

- Whether they qualify as workers under the Act

Managerial and supervisory roles are excluded from statutory overtime, but companies may still include them under an internal overtime compensation policy.

3. IT and service companies

An overtime policy in IT companies is governed by:

- Company policy

- Contractual terms

- State Shops and Establishments Acts (not the Factories Act)

This is why overtime rules differ widely across IT firms.

Mandatory vs Discretionary Overtime

A common question employers ask is whether overtime can be forced, especially when deadlines are tight, staffing is limited, or unexpected situations demand extra working hours. Here is how this distinction is generally understood in the workplace overtime policy in India.

Mandatory Overtime Policy

Indian labour laws discourage forced overtime. However:

- In exceptional business or safety situations, limited mandatory overtime may be allowed

- It must still follow compensation rules

- Chronic or routine mandatory overtime is legally risky

Any mandatory overtime policy should be approached carefully and documented clearly.

Discretionary Overtime Policy

Discretionary overtime refers to additional hours worked by employees by choice rather than compulsion. These situations are usually driven by individual workload, deadlines, or employee willingness rather than urgent operational necessity.

Even discretionary overtime must be tracked accurately and compensated in accordance with applicable labour laws. Clear approval processes help ensure that voluntary extra work does not turn into an informal expectation over time.

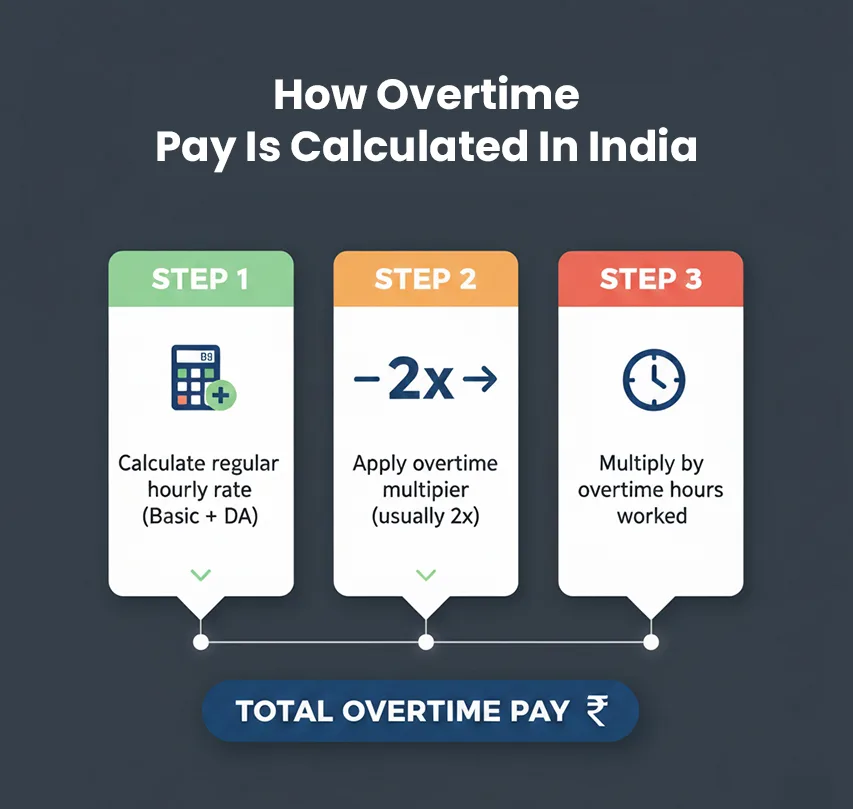

Overtime Compensation Policy: Calculating Premium Pay

The most common question around overtime is how to calculate the premium pay. Under Indian labour laws, eligible employees must usually be paid twice their ordinary rate of wages for overtime, subject to the specific Act or State rules that apply to your establishment.

Step 1: Calculate the regular hourly rate

For monthly salaried employees

Here, wages usually mean basic pay + dearness allowance (DA), and exclude discretionary bonuses.

Regular Hourly Rate = (Basic Salary + Dearness Allowance) ÷ (Working Days in a Month × Daily Working Hours)

For hourly workers

Regular Hourly Rate

= Contractual Hourly Wage

Step 2: Apply the overtime multiplier

Overtime Hourly Rate

= Regular Hourly Rate × Overtime Multiplier

Step 3: Compute total overtime pay

Total Overtime Pay

= Overtime Hourly Rate × Total Overtime Hours Worked

Eligibility and Exemptions

Not every employee is entitled to the same overtime policy. Indian labour law provides exemptions for certain categories:

| Employee Category | Overtime Eligibility | Rationale |

|---|---|---|

| Worker (Non-Exempt) | Yes, Mandatory | Covered by the Factories Act or S&E Act. Entitled to double-rate pay for all extra hours. |

| Managerial/Supervisory | No, Exempt | Considered to be in a position of authority or a confidential role. |

| Administrative/Executive | No, Exempt | Usually defined by the nature of duties and the salary threshold. |

Essential Components of an Effective Overtime Policy Template

1. Eligibility Criteria

- Define which employees are eligible for overtime pay

- Specify exempted categories (if any) with legal justification

- Clarify how employee classification affects overtime entitlement

2. Overtime Approval Policy

- Establish a clear approval workflow before overtime work begins

- Designate authorised approvers (supervisors, managers, HR)

- Set guidelines for emergency overtime situations

- Implement digital approval systems for better tracking

3. Overtime Compensation Policy

- Clearly state the overtime pay rate (1.5x, 2x regular wages)

- Specify calculation methods for different employee categories

- Define payment timelines (same month, following month)

- Outline alternatives like compensatory off policies

4. Maximum Limits and Restrictions

- Set daily and weekly overtime caps aligned with labour laws

- Include mandatory rest period requirements

- Establish health and safety considerations for extended hours

5. Record Keeping and Compliance

- Maintain accurate time and attendance records

- Document all overtime approvals and payments

- Ensure audit trails for labour law compliance

- Retain records as per statutory requirements (typically 3–5 years)

Overtime Policy Sample: Quick Reference Checklist

- Legal compliance with applicable labour laws

- Clear definition of regular vs. overtime hours

- Transparent compensation rates and calculation methods

- Formal approval and authorisation processes

- Maximum overtime limits per day/week/month

- Record-keeping and documentation requirements

- Health and safety considerations

- Grievance redressal mechanisms

- Communication and training protocols

- Regular policy review and update procedures

Why Technology Matters for Overtime Policy Compliance

The number one reason why errors happen in the overtime calculator is manual tracking. If you are an organisation that values employee satisfaction and does not want to enter into disputes with them, and subsequently incur compliance risks, modern workforce management platforms are the right solution. They can make your overtime policy implementation easier through automation and real-time visibility.

- Automated time tracking: Captures work hours accurately without manual intervention

- Digital approval workflows: Routes overtime requests through proper authorisation channels instantly

- Real-time compliance monitoring: Flags violations before they become legal issues

- Integrated payroll calculation: Computes overtime wages correctly using predefined multipliers

- Comprehensive audit trails: Maintains detailed records for statutory compliance requirements

Platforms like Mewurk are well-reputed for helping organisations manage overtime tracking and policy compliance more easily through their automated workforce management tools.

Closing Note

A fair overtime policy can equally benefit both the employer and employee. Whether you are an employer creating an overtime policy template or an employee understanding your rights, clarity on these regulations empowers better workplace relationships.

Remember, the best overtime policy isn't the one that extracts maximum hours from your employees but one that respects legal boundaries, values their wellbeing, and aligns with your organisational ethos and goals.

Frequently Asked Questions

1. Are Gig Workers (e.g., Uber, Swiggy) protected by India's overtime laws?

No. Gig and platform workers are generally excluded from the traditional, fixed-hour overtime protection of the Factories Act. Their compensation is based on contractual agreements and task completion.

2. Which overtime law applies if my company has both a factory and an office?

The law depends on the employee's role. Factory workers are covered by the Factories Act. Administrative staff fall under the state-specific Shops and Establishments Act of the location they work in.

3. Does the 'Right to Disconnect' mean my boss cannot call me after work?

Not exactly. The Right to Disconnect encourages limits on after-hours work calls, but it doesn’t ban them outright. Emergencies or agreed-upon roles may still require contact.

4. What is the difference between overtime pay and compensatory off?

Overtime pay is extra wages paid for working beyond daily or weekly working-hour limits. Compensatory off is paid time off given for working on a weekly rest day or holiday. Comp-off cannot replace legally required overtime wages under labour laws.

5. Where can I find an overtime policy in India PDF, or template for my organisation?

You can download a ready-to-use Overtime Policy in India PDF using the link here. Review and tailor it for your industry, state-specific labour laws, and internal practices. A legal review is recommended before rolling it out.

Most Popular Post

Why Accurate Attendance and Leave Management Matters for Business Growth?

Read More →Why Accurate Attendance and Leave Management Matters for Business Growth?

How To Leverage Attendance Data For Better Workforce Management?

Read More →How To Leverage Attendance Data For Better Workforce Management?