Five Salary Processing Challenges You Can Overcome with Payroll Management Software

Payroll. The word alone is enough to make small business owners break into a cold sweat, and for good reason. You don't need to study rocket science to know that if the salary calculation goes wrong, your employees won't be happy.

Companies, big or small, and depending on what kind of work they do and how many people they employ, might use different ways to handle salaries.

This could be anything from doing it all by hand to using special computer programs. But one thing's for sure: if you're not using a modern way to do payroll, that is using an advanced payroll management software, you're probably getting older faster every time you have to figure out how much tax to take out of someone's paycheck. It's just that much of a brain drain.

So, what exactly can this payroll management software do for you? Well, this blog post will walk you through the top five headaches that modern automated salary processing systems could tackle, so keep reading to find out how much easier your life could be at the end of every pay cycle.

Manual Math: The Leading Payroll Headaches Since Forever

If you've ever had to figure out overtime pay for a bunch of people - say, 50 - and also remember who opted for the new tax regime and who are still with the old regime, you know that it can get really confusing. If you mess up just one tiny number or miss a tax update, suddenly you're dealing with underpayments, overpayments, or worse. And before you know it, you're facing a mob of furious employees demanding answers (and the right pay).

How Payroll Management Software Helps?

When it comes to reducing manual tasks related to salary calculation and payout management, payroll management software comes equipped with a variety of automation tools to speed up the process, such as:

- Payroll automation tools help cut down manual data entry, which in turn reduces errors.

- Salary processing systems automatically calculate deductions, bonuses, and taxes.

- Pay slip generation tools ensure every payslip is accurate (and legible).

Accurate Tax Filing Is a Requirement—Not an Option

Tax compliance requirements tend to shift with every budget announcement. When that happens, as a business owner, it becomes your responsibility to ensure the latest rules are applied accurately and on time. With so many operational demands already on your plate, keeping up with local, state, and federal tax regulations can feel nearly impossible. In fact, managing it manually would practically require hiring someone full-time, something many small businesses simply can't afford. Here, affordable payroll solutions for startups will step in as a smart alternative.

How Can Payroll Management Software Simplify Tax Filing?

Cloud-based payroll software with built-in tax filing capabilities can:

- Automatically update changes in tax laws and calculations, so you're always compliant.

- Flag discrepancies before they lead to costly penalties or fines.

- Automate the submission of tax returns on your behalf and save you time while lowering the risk of errors.

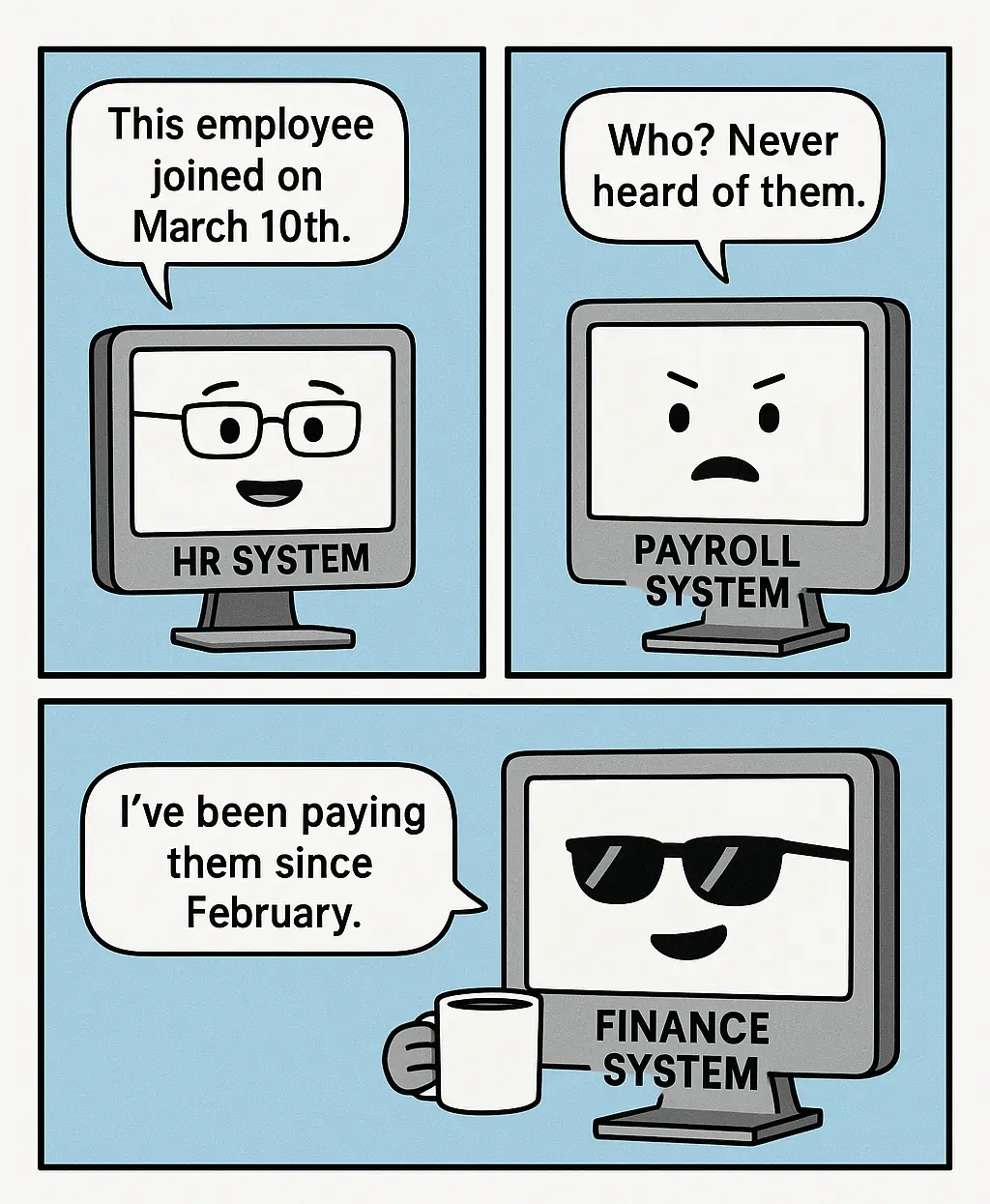

The Trouble with Disconnected Attendance and Leave Records

Payroll is closely linked to your employees' attendance and leave data. If this is mismanaged, errors are bound to happen. Until quite recently, it was done manually since there was no attendance-linked payroll reporting system. Towards the payroll cycle, each employee would submit a form mentioning the number of days worked and total leaves taken. The HRs or payroll head would then compile this data manually and calculate salaries.

But that is not the case anymore. Now, there are HR and payroll software solutions which can facilitate real-time coordination between HR, payroll, and finance data.

How Payroll Management Software Helps?

- Attendance-linked payroll system syncs clock-in data and automates salary calculations.

- Through HR and payroll integration, accrued leave balances are deducted both accurately and automatically.

- Wage management solutions adjust for overtime without requiring any manual input.

Salary Revisions and Arrears: The Real Test for Payroll Teams

The time of appraisals and salary revisions is an exciting period for most employees in an organisation, except for the payroll team. That's because the revisions are unique to each employee, and there's no way to apply a single default update across the board. With every salary increment, there are cascading changes in tax slabs, deductions, and other statutory components. On top of that, the need to document all these updates becomes yet another major headache.

How Does Payroll Software for Small Businesses Simplify This?

- A Payroll compliance software can automatically calculate arrears based on effective dates and revised salary structures

- Businesses can apply revisions mid-cycle in the salary processing system without disrupting the ongoing payroll process

- The employee compensation management system maintains compliance with statutory deductions like PF, ESI, and TDS

Payroll Data Breaches: A Risk You Can't Afford to Ignore

No company data should ever be compromised. But if you were to rank company files by their level of privacy and confidentiality, employee payroll data would be among the top five priorities.

From base salary and tax details to banking information, employee salary records should never be stored in plain spreadsheets that can be accessed by anyone who gains entry into the company's system. This data needs to be both encrypted and securely protected. Nothing does this better than the best payroll management software for small businesses in India.

Four Ways Payroll Management Software Keeps Employee Data Safe

- Role-based access controls: Modern wage management solutions are equipped with role-based access control, which restricts the ability to view or edit sensitive salary and employee data to authorised personnel.

- Data encryption: Advanced payroll systems protect employee data through end-to-end encryption so every piece of sensitive data remains secure while stored on servers or being transmitted over a network.

- Activity logs: With the help of detailed audit trails, admins can track every action taken in the system, hence strengthening transparency and accountability.

- Cloud backups and secure servers: A reliable payroll solution would be backed by robust cloud backups and secure server infrastructure to safeguard data from accidental loss, cyberattacks, or hardware failures.

The Bottom Line

Payroll processing can be a tough nut to crack, but here's the silver lining: with payroll management software, you can eliminate up to 95% of payroll-related headaches.

The five key wage management challenges outlined here are a perfect starting point to consider automating your payroll. With the right solution, these hurdles become a thing of the past.

Looking for a modern, affordable, and fully integrated payroll solution that caters to businesses of all sizes? At Mewurk, we've designed exactly that. Try it free and experience how it can simplify your payroll process.

Most Popular Post

Why Accurate Attendance and Leave Management Matters for Business Growth?

Read More →Why Accurate Attendance and Leave Management Matters for Business Growth?

How To Leverage Attendance Data For Better Workforce Management?

Read More →How To Leverage Attendance Data For Better Workforce Management?